2024 Financial Wrap Up – Key West, Florida, USA, January 20, 2025

It has been an eventful year, and I always like to do a review of the year to see what worked, what didn’t, and how to set us up moving forward. So here goes. This past year we had two daughters graduate from college (yeah!), sailed the southern Caribbean thru April, bought the RV in May, lost the boat in June (and nearly everything we owned on it), travelled to Grenada twice, Hawaii once, learned A LOT about insurance, and covered the rest of the US via camping. I don’t think we have to worry about being bored in retirement. Financially speaking, it was another good year for us too. Ron had a large consulting project he worked on between camping and Hawaii and it was a good year on the stock market (Thank You Biden!). Inflation has cooled, which is good but also lowers rates a bit. Now that Trump is coming into office, I expect rates to be steady or start increasing again like they did in his first term. We will see if I am correct or not as of today…inauguration day.

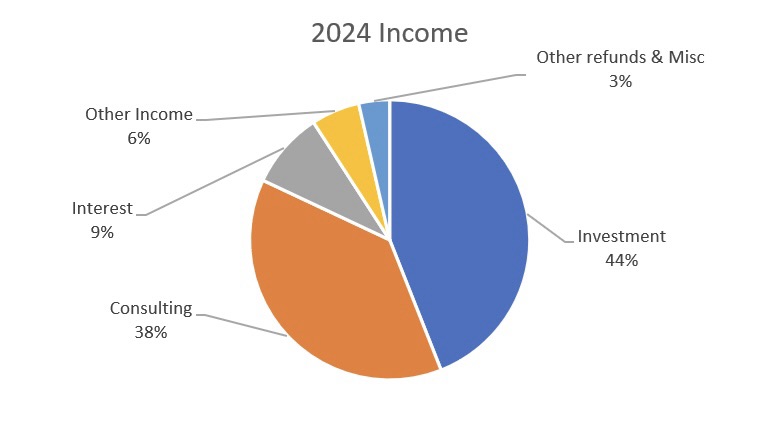

Let’s get into the specifics starting with income. We increased our income year over year by 17%! This is in part due to Ron’s consulting work but also our investments have grown well as the stock market continues to break records and the interest rates have remained high. The other piece of good news is our investment income is now the primary generator of our income and is currently not invested in any individual stock (except one) so when/if there is a down time in the market, it should not affect our income. This also helps in that as Ron’s consulting income fluctuates it should not affect our lifestyle that much. We also had an increase since we now have the cost of the boat invested, which has increased the investment output.

Ron and I like to live by the motto “Cash Flow Positive.” We monitor this very closely every month and there have only been 1-2 months over our entire retirement where we have spent more than we have made (even in retirement!). The Empower App has been a fantastic tool to track not only our cash flow but also our overall net worth.

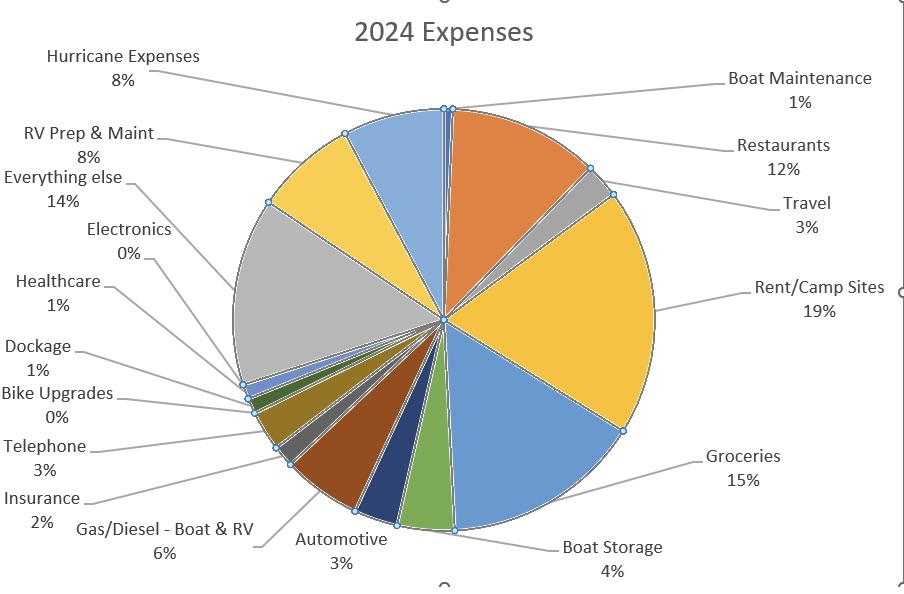

Moving on to our expenses for the year, which have increased but not as much as I would have expected. Overall, we only spent about $10K more than last year (not including the initial expense of the RV). Not too bad considering all that has happened with the hurricane etc. In addition, we have set ourselves up to live more leanly next year while still enjoying our travel lifestyle. We now have the RV which is much cheaper than an apartment or an Airbnb in our hurricane season. We have also identified a boat which is cheaper than land life for our Caribbean lifestyle.

Reviewing the expenses over prior years there wasn’t anything too surprising. We spent more on rent/camp sites because we were on land instead of the boat this fall. The other side of that is we spent less on boat dockage, insurance, storage, and maintenance, etc. We did have some deductions and travel expenses due to Ron having to travel to the boat several times due to the hurricane. We also spent less on auto expenses since we were driving the RV or motorcycle instead of a rental car for a good chunk of the year. Outfitting the RV was a chunk because we added lithium and solar to that, but it is a onetime expense. The everything else category also jumped a bit since we had to replace some of the items we lost in the hurricane like clothing etc. Overall, I think this year was a success because even though we had higher expenses we had a significantly higher income to compensate. Our cash flow positivity was double what it was last year, and this is a key indicator in how we are doing. Here are the details.